According to the 2016 Putnam Social Advisor Survey, 33% of advisors focusing on LinkedIn as their primary social network are paying for a premium account.

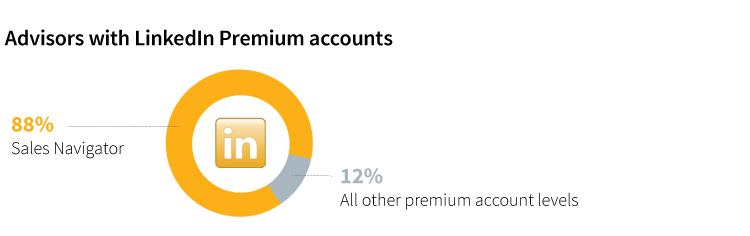

Premium accounts are tailored to various segments (job seekers, recruiters, business professionals), and an ultra-premium Sales Navigator membership unlocks and customizes delivery of LinkedIn’s rich data. Among advisors using a premium version, 88% are using Sales Navigator.

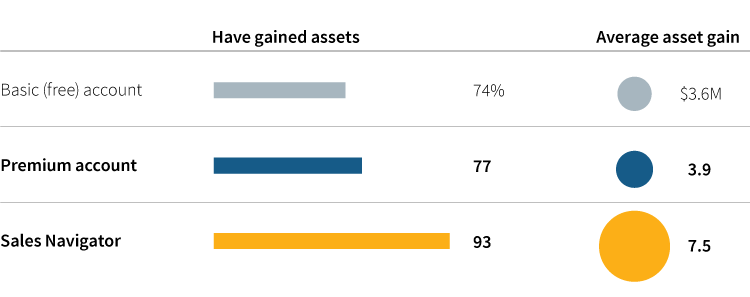

Advisors using Sales Navigator are reporting asset gains that far exceed gains made by those using other premium options. In fact, the average asset gains attributed to other premium options are only marginally greater than those from use of LinkedIn’s basic account option.

Is a premium account right for you?

A premium account may be worth the investment if you use LinkedIn daily for networking and prospecting, and have seen some measure of success. If you are considering investing in a Premium account, set goals and benchmarks like “generating a prospect list based on my client profile” or “one new prospect every month” so you can measure its value.

307588 8/17