Headlines about the global impact of the coronavirus (or COVID-19) contribute to growing uncertainty for governments, markets, and individual investors. The uncertainty is understandable — markets and news are changing quickly. As investors ride out a wave of complicated and sometimes conflicting news stories, they are likely to turn to financial advisors with questions about investments and exposure to risk:

“Am I overinvested in markets affected by the pandemic?”

“How are shutdowns and supply chain disruptions in China affecting my investments?”

“Am I invested in companies that have issued earnings warnings?”

“Is now the time to get out of X investment or to rebalance my portfolio?”

Having access to high-quality information resources on the business, market, and social impacts of coronavirus is key to answering questions and reassuring clients rattled by changing events. Easy access to details on clients’ holdings is also an important part of the equation.

Here are resources for both kinds of information.

Health information from the Centers for Disease Control (CDC)

Clients may be receiving emails about coronavirus from employers, schools, or local communities that contribute to a heightened sense of concern. They may also come across misinformation online about the severity and spread of the virus.

For the most recent information on the government response to COVID-19, check the Centers for Disease Control website. The CDC offers a regular update on the virus in the United States and globally, an assessment of risk, and actions the CDC is taking in response. This information can help provide facts to counter fears or misinformation.

Business and market news on the coronavirus

With many takes on the pandemic filling newsfeeds, it is helpful to have consolidated, trusted sources for business news related to the coronavirus. Outlets, including The Wall Street Journal, Financial Times, CNBC, and MarketWatch, have all created dedicated coronavirus sections with frequent updates on business and the markets.

The New York Times and The Washington Post also maintain live coverage sections with general news about the coronavirus.

Details on holdings and risk exposure from FundVisualizer

As companies continue making announcements about disruptions to supply chains, adjustments to earning and sales projections, and other issues related to the coronavirus, investors are likely to have questions about holdings and their exposure risk.

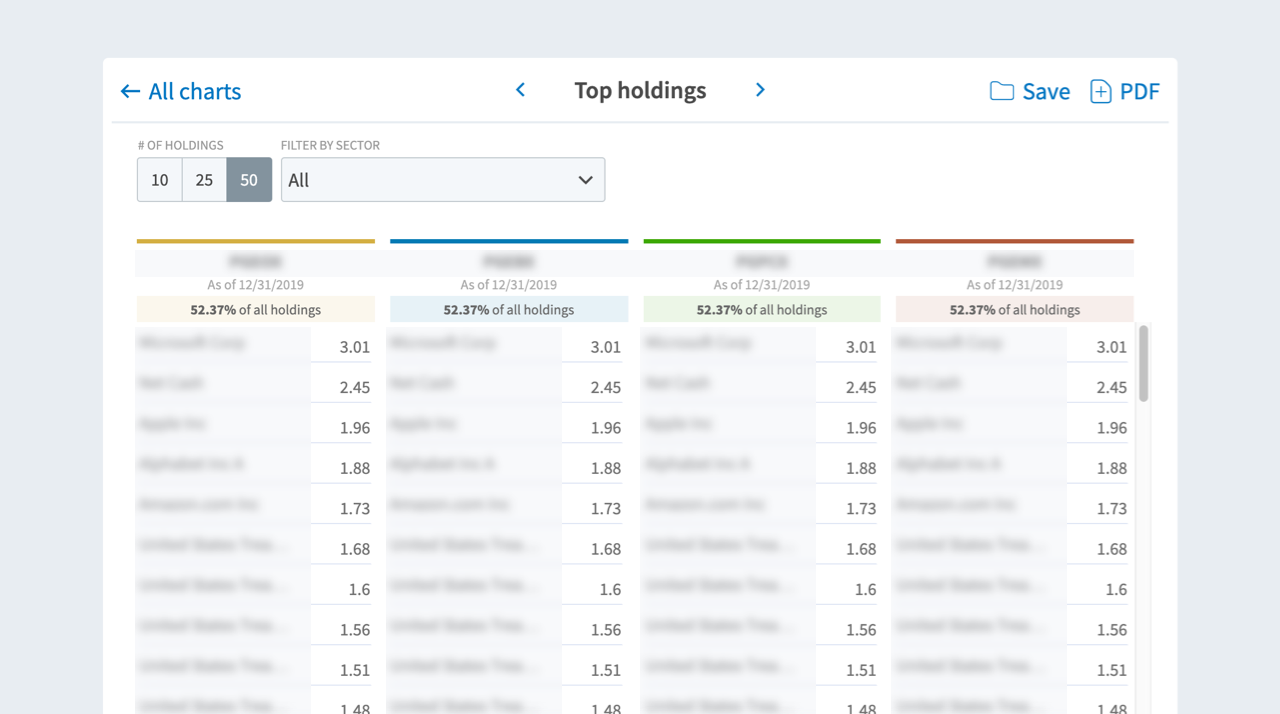

When clients approach you with questions about how specific companies or sectors might be affecting their portfolio, FundVisualizer makes it easy to find the top holdings in more than 30,000 funds, ETFs, and indexes.

Start by clicking “Compare” from the FundVisualizer home page. From there, you can search by fund name or ticker. Choose one fund or add an entire list, then click “Create”. You can also import a client’s portfolio.

From the FundVisualizer chart options, click “Top holdings.”

FundVisualizer will display a chart listing the top 10, 25, or 50 holdings for each selected fund. You will see the listings in order of size, with overall percentage noted.

This information helps you to look at the overall makeup of the fund, and to consider how specific company holdings or sectors might contribute to performance.

To explore all the features of FundVisualizer, visit FundVisualizer.com.