More than 3.1 million Americans age 55 or older plan to apply for Social Security benefits earlier than expected due to the pandemic, according to the United States Census Bureau. That said, many making the jump to retirement may not have sufficient resources in place.

Advisors have an opportunity to support these clients by reviewing their goals to determine if their income needs, savings, and healthcare coverage are adequate for an earlier-than-planned retirement. Advisors can also help individuals identify the optimal age to claim Social Security.

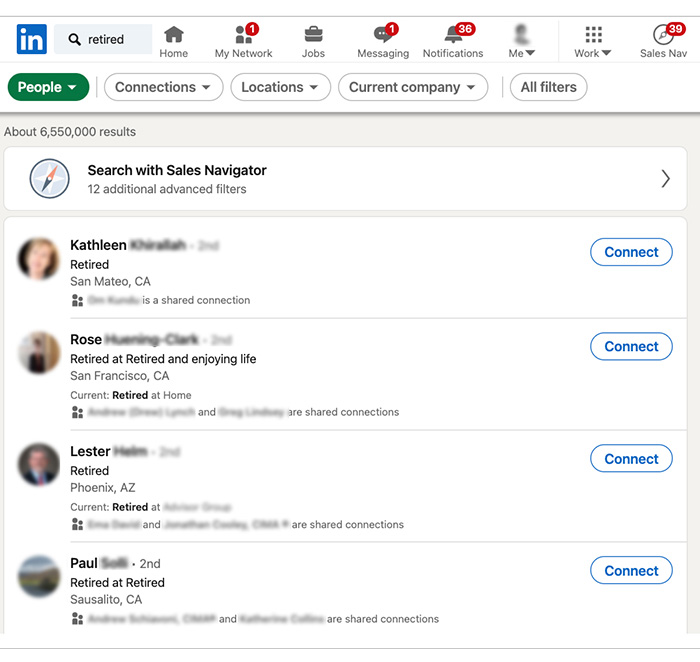

How are advisors finding these individuals? LinkedIn can help. Advisors can begin with a keyword search for those who noted that they are retired. Type “retired” into the search bar and narrow down further using “All filters.”

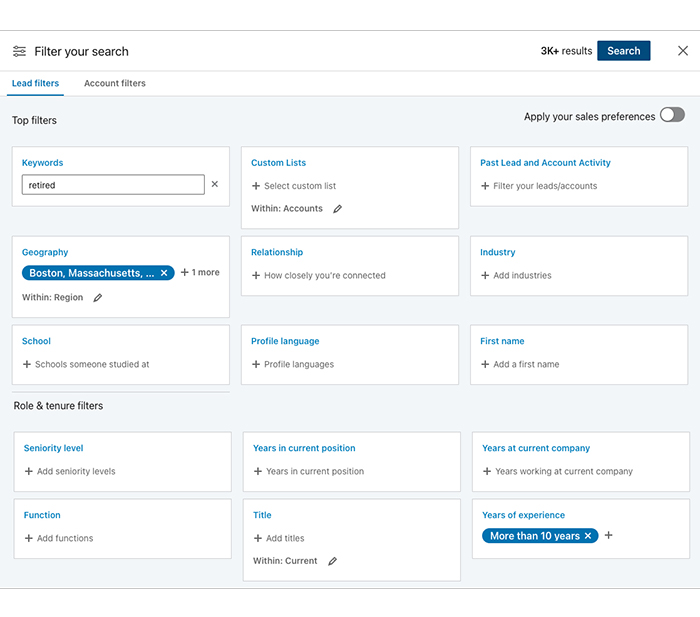

If you are using LinkedIn’s Sales Navigator product, you can further refine your search by focusing on those within a geographic area or zip code, or those with a specific career tenure.

Connect with the individuals on LinkedIn once you have identified a list of prospects. Be sure to follow these Pro Tips:

- Personalize your invitation to connect rather than sending a blank connection request.

- Provide context to your prospect to improve your chances of making a valuable new connection. LinkedIn members are more likely to connect if they know why you are reaching out. Try mentioning contacts you have in common, or congratulating them on their retirement.

- Follow through with new connections. Once your invitation is accepted, arrange a call or use LinkedIn to message them to discuss details about their retirement finances.

Financial advisors: Consult with your firm’s compliance department and be fully aware of its policies and procedures before you engage in any social media activities. Content is offered for informational purposes only and is not meant as an endorsement for any particular app, mobile device, or social networking site.

326380 6/21